Electronic devices are indispensable in our lives, but they emit various electromagnetic waves of different frequencies and wavelengths, which can interfere with nearby circuits and devices. This can disrupt the normal operation of precise electronic instruments and pose information security risks. With the advancement of technology, the number of electronic devices and products is constantly increasing. These devices contain diverse, compact, precise, and high-density electronic components, leading to increasingly harmful electromagnetic interference. Electromagnetic interference has become a problem that the electronics industry must address.

Electromagnetic shielding materials are designed with the purpose of reflecting or absorbing the energy of electromagnetic waves to attenuate their propagation and block their transmission path. These materials enable electromagnetic compatibility for electronic devices and components, making them an ideal solution to tackle electromagnetic interference. The principle behind electromagnetic shielding materials is that when incident electromagnetic waves reach the surface of a shielding material, some of the waves are reflected back due to the impedance mismatch between the air and the shielding material. The waves that are not reflected and enter the material are absorbed and attenuated during their propagation. When a small amount of the remaining waves reach the interface between the shielding material and the air, they are reflected back into the shielding material due to the impedance mismatch, and are absorbed and attenuated again.

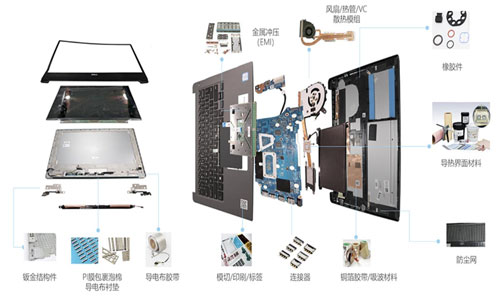

Common electromagnetic shielding materials include conductive fabric, conductive adhesive tape, conductive foam, conductive sponge, conductive rubber, conductive coating, and absorbing materials. These materials find widespread applications in communication devices, computers, consumer electronics, automotive electronics, and defense industries.

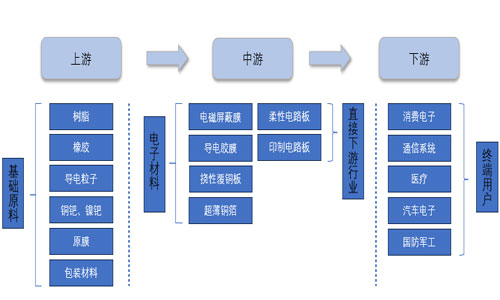

The electromagnetic shielding material industry belongs to the field of advanced materials. Its upstream sector consists of suppliers of basic raw materials, the midstream sector consists of manufacturers of electromagnetic shielding materials and devices, and the downstream sector includes various terminal applications, such as communication devices, computers, smartphones, automotive electronics, household appliances, and defense industries.

In terms of demand, with the advancement of mobile communication technology and the continuous advancement of informatization construction, the electronic industry has achieved high growth. Electronic devices are equipped with higher hardware configurations, processors are upgrading towards high-performance multi-core directions, and display screens are trending towards larger sizes and higher resolutions. The internal components are becoming more precise and integrated. With the continuous upgrading of electronic devices, higher frequencies and higher power consumption will require higher EMI shielding performance. This will drive the continuous diversification of electromagnetic shielding materials, as well as improvements in material performance and processing techniques.

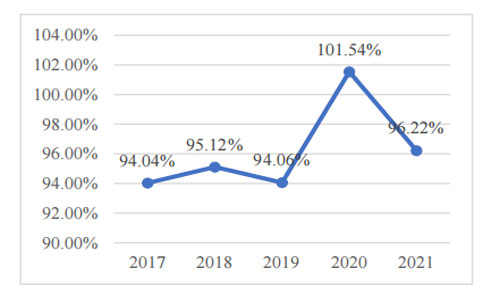

In terms of supply, the electromagnetic shielding material industry started relatively late in China, and high-end technologies are mostly monopolized by manufacturers from developed countries. Currently, most electromagnetic shielding material manufacturers in China are concentrated in the low-end market. The low-end market has many participants but lacks differentiation, resulting in a situation of oversupply. In the high-end market, China mainly relies on imports, but there are a few domestic manufacturers that have broken through technological barriers and have the capability to research and produce high-end electromagnetic shielding products. Looking at the overall market, the production and sales of electromagnetic shielding materials in China is in a slight surplus-balanced state, with fluctuations between 94% and 102% from 2017 to 2021.

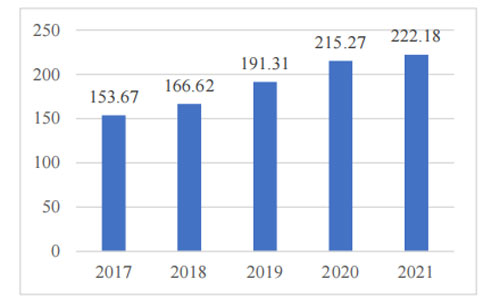

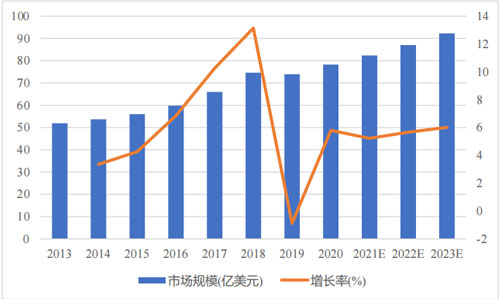

The market size of the electromagnetic shielding material industry in China has experienced rapid expansion around 2018 and has now entered a phase of stable growth. However, there is still no strong downstream consumer pull. Globally, according to BCC Research, the global market for electromagnetic shielding materials has gradually expanded in recent years, growing from 5.2 billion USD in 2013 to 7 billion USD in 2018, an increase of 1.8 billion USD in five years. BCC Research predicts that by 2023, the global market for electromagnetic shielding materials will reach 9.25 billion USD, an increase of 2.25 billion USD from 2018, with a compound annual growth rate of 5.7%. From 2019 to the present, the growth rate of the market size has been relatively stable, indicating that the industry has entered a more mature stage, with a similar overall situation to the Chinese market.

Currently, there are three main types of electromagnetic shielding materials: conductive adhesive, metal alloy, and microneedle. The most widely used type in the market is the metal alloy electromagnetic shielding film. Metal alloy electromagnetic shielding films were first introduced to the market around 2000 by Tatsuta (Japan). They met the demand for multiple bends of flexible circuit boards and were widely used in flip phones and slide phones. Subsequently, manufacturers such as Toyo Science (Japan) also launched similar products. Conductive adhesive electromagnetic shielding films were first introduced to the market by Toyo Science around 2009. Due to their early entry into the market, developed countries such as Japan and the United States lead in the research, development, and production of electromagnetic shielding materials, with leading enterprises holding approximately 70% of the international market share and enjoying a monopoly position in the high-end technology field.

In the Chinese market, major brands in the field of electromagnetic shielding materials include Laird, Gomelast, Fidelity, Longyang Electronics, Zhongshikaida, and Shenzhen Hongfucheng. Foreign-owned companies such as Laird and Gomelast still have obvious advantages in related technical indicators in the Chinese market. Domestic companies started relatively late and are fewer in number. The market concentration is relatively dispersed, and there are diverse types of electromagnetic shielding materials and devices with low technical barriers.

Contact: Pamela

Phone: +86 189 6365 3253

E-mail: info@industryprocess.com

Whatsapp:+86 189 6365 3253

Add: Yajing Industrial Park, No. 59 Shuangjing Street, Weiting Town, Suzhou Industrial Park

We chat